Understanding the Importance of Changing a Stop Loss Order in Trading

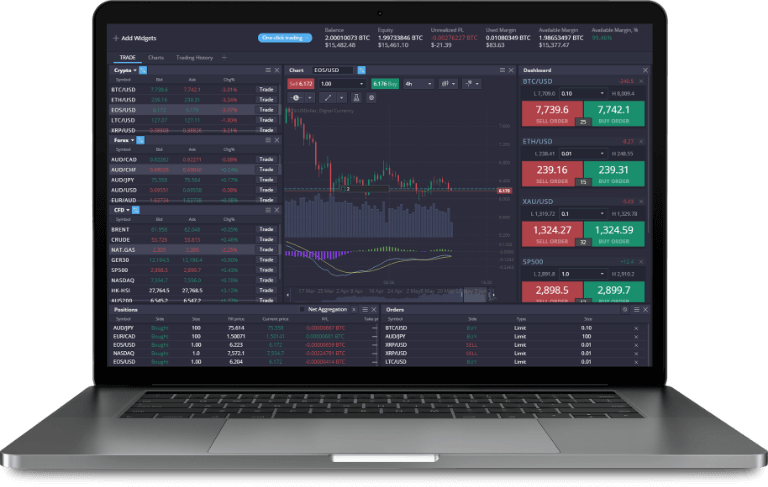

In the world of trading, managing risk is paramount to achieving long-term success. One of the most effective ways to manage risk is through the use of stop loss orders. These orders help traders minimize potential losses on their investments. However, the conditions of the market can change rapidly, necessitating adjustments to your stop loss order. changing a stop loss order after it’s placed on primexbt trading bonuses PrimeXBT, which can further enhance your trading strategy and risk management.

What is a Stop Loss Order?

A stop loss order is a predetermined price level set by a trader to limit losses on a position. When the asset price reaches the specified stop loss level, the order is executed to sell the asset immediately, thus preventing additional losses. While this strategy is mainly used to protect capital, it can also help traders lock in profits by trailing up with the price of the asset.

Why Change Your Stop Loss Order?

Trading is inherently dynamic, and markets can exhibit volatility at any moment. Here are some reasons you might consider changing your stop loss order:

- Market Volatility: Economic news, geopolitical events, or sudden market fluctuations can affect asset prices dramatically. Adjusting your stop loss can help you accommodate this volatility.

- Profit Taking: As an asset price increases, moving your stop loss order higher can help secure profits. This is often referred to as a “trailing stop loss.”

- Changing Market Sentiment: If sentiment shifts and you no longer feel confident in your position, adjusting the stop loss may be wise to safeguard your investment.

- Technical Analysis Signals: Changes in technical indicators may necessitate altering your stop loss order to align with new insights from chart patterns or price levels.

How to Change Your Stop Loss Order?

Changing a stop loss order can vary depending on the trading platform you use, but generally involves a few straightforward steps:

- Log in to Your Trading Account: Open your trading platform and navigate to the section where your current positions are displayed.

- Select the Position: Find the specific trade for which you want to change the stop loss order.

- Modify the Stop Loss Order: There will typically be an option to edit or modify your existing stop loss. Enter the new stop loss level you wish to set.

- Confirm Changes: Ensure that you review and confirm the adjustments before finalizing the changes to your stop loss order.

Strategies for Setting Stop Loss Orders

When changing or setting a stop loss order, various strategies can help enhance your risk management approach:

1. Use Volatility-Based Stop Losses

One popular method is to set stop loss orders based on the volatility of the asset. Tools like the Average True Range (ATR) can help you determine how much the price typically swings, allowing you to position your stop loss accordingly.

2. Chart-Based Stop Losses

Many traders use support and resistance levels identified through technical analysis. Placing your stop loss just below a strong support level can provide an extra layer of protection against market dips.

3. Time-Based Adjustments

As time progresses in a trade, your analysis may evolve. Some traders prefer to adjust their stop loss orders during critical scheduled events or after certain periods to account for market behavior.

Common Mistakes When Changing Stop Loss Orders

While changing your stop loss order is a part of effective risk management, there are several common pitfalls to avoid:

- Overreacting to Market Noise: Frequent adjustments due to minor fluctuations can lead to unnecessary losses. It’s essential to remain focused on the bigger picture.

- Not Following a Plan: Every action should follow a coherent trading strategy. Random changes can erode your trading discipline.

- Failing to Secure Profits: As the market moves in your favor, be proactive about adjusting your stop loss to lock in gains rather than just moving the stop in the same direction as the trade.

Conclusion

Changing a stop loss order is an essential part of managing risk in trading. By understanding the importance of adjusting your stop loss based on market conditions and employing strategic methods, traders can protect their investments while maximizing profit potential. Moreover, taking advantage of resources and bonuses like those available through PrimeXBT can further refine your trading strategies and bolster your overall trading experience.